- Unichain TVL reaches $322.99 million with on-chain stablecoin growth.

- Weekly growth rate of on-chain stablecoin TVL hits 1977%.

- $5 million UNI incentive accelerates liquidity influx.

Uniswap’s newly launched Layer-2 network, Unichain, has achieved a total value locked (TVL) of $322.99 million as of April 22, 2025, according to DefiLlama data.

This surge illustrates Unichain’s role in driving DeFi advancement by enhancing network efficiency and liquidity management.

Unichain: Driving DeFi Growth with $5 Million Incentives

Unichain, a Layer-2 initiative by Uniswap, has surpassed a TVL of $322.99 million, driven by a substantial $5 million UNI incentive. This incentive is designed to attract liquidity through 12 key pools featuring major assets such as USDC/ETH.

This rapid increase in TVL, alongside the ongoing incentive program, underlines strong market optimism. The attractiveness of incentives has significantly boosted daily trading volumes and liquidity on Unichain, indicating favorable market reception.

“Unichain is built differently […] We’re here to make DeFi faster, cheaper, more decentralized, which is why we launched Unichain to be permissionless from day one.” – Hayden Adams, Founder & CEO, Uniswap Labs, source

Unichain’s Record TVL and Market Implications Analyzed

Did you know? Unichain’s TVL performance exceeds typical incentive-driven TVL growth, reflecting a more substantial market response compared to analogous Layer-2 initiatives.

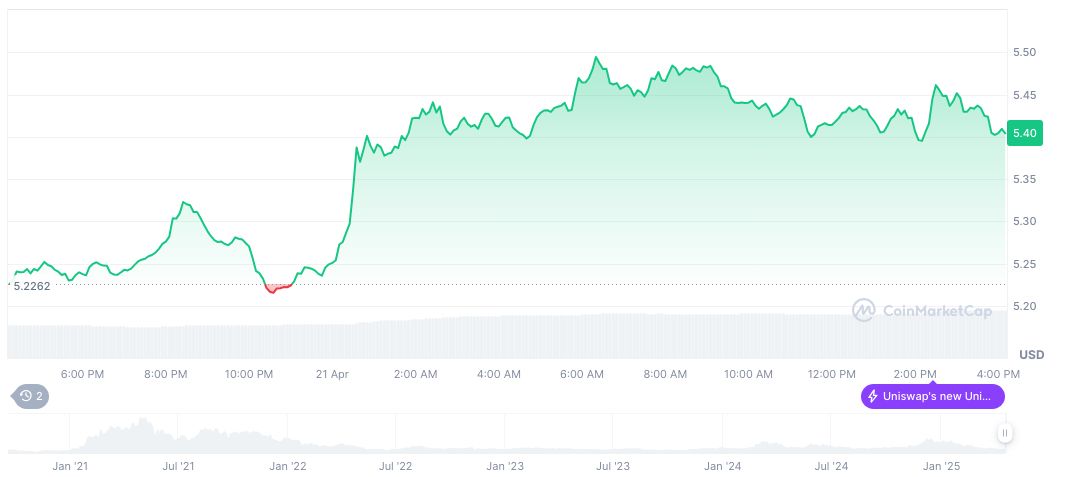

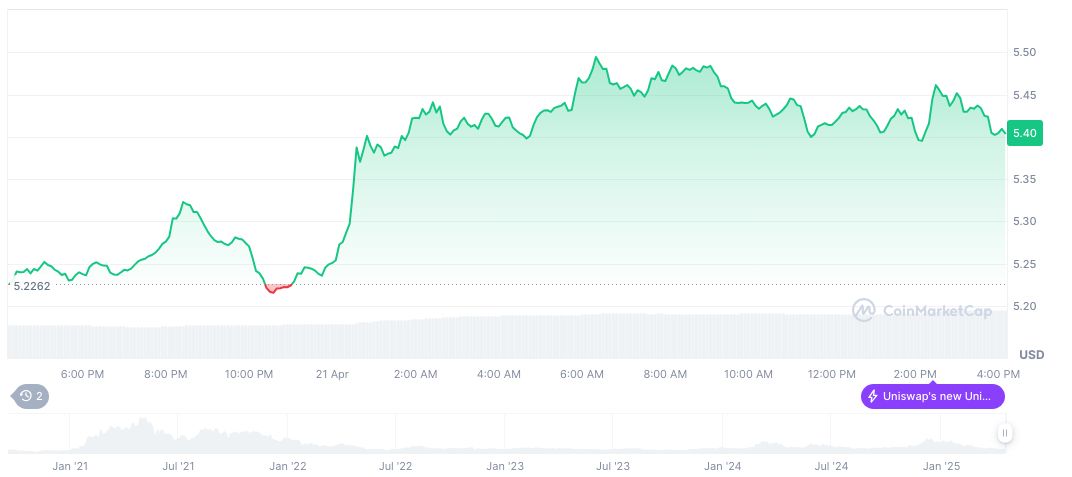

Uniswap (UNI) currently trades at around $5.33 with a market cap of $3.35 billion and maintains a market dominance of 0.12%, according to CoinMarketCap. Despite recent TVL milestones, UNI’s price has declined by 2.53% over the past 24 hours, continuing a downward trend over the past three months.

Coincu research suggests that the increased liquidity could potentially lead to enhanced price stability and market participation, despite recent price declines. Analysts note that such robust activity around Unichain could provoke further technological innovations and market strategies.